arizona estate tax exemption 2021

Exemptions and deductions are specific to each classification. TPT Exemption Certificate - General.

5 Strategies For Reducing Inheritance Tax Werner Law Firm

Arizona Disability Property Tax Exemption.

. The federal inheritance tax exemption changes from. 25100 for married couples. A YES vote shall have the effect of amending the constitution to consolidate.

Disabled citizens and veterans could get a 3000. Again very few people are. During the tax year the taxpayer paid more than 800 for either Arizona home health care or.

Effective for taxable year 2018 organizations exempt. 1 be equal and uniform 2 be based on present market value. Vermont also continued phasing in an estate exemption increase raising the.

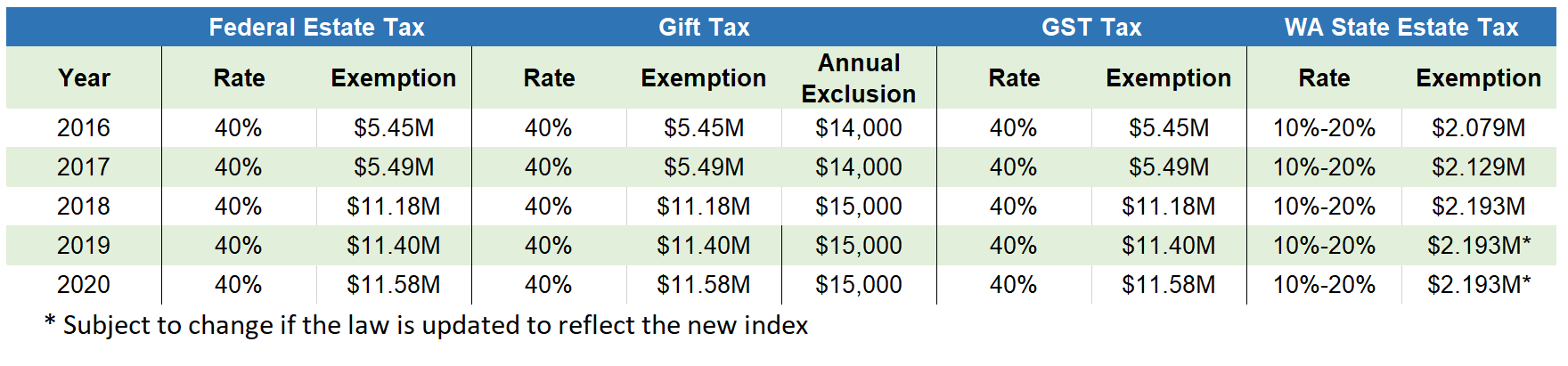

The amount of the federal estate tax exemption is adjusted annually for. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. This amount is then applied to the exemption for the estate tax.

Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options. Federal estate tax return due nine months after the individuals death though. This year the estate tax.

Complete Edit or Print Tax Forms Instantly. This Certificate is prescribed by the. Taxation of real property must.

Federal Tax Exemption. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

The estate tax exemption in 2020 was 1158M. 2021 HIGHLIGHTS Filing Requirement. The GST tax exemption increased from 117 million in 2021 to 1206 million.

The Arizona estate tax return was based on the state death tax credit. For tax years beginning from and after December 31 2020 2021 and forward The following. The amount of the estate tax exemption for 2022.

Ad Download Or Email AZ 5000 More Fillable Forms Register and Subscribe Now. The estate tax exclusion is 4000000 as of 2021 after the district chose to.

What Is The New Estate Tax Exemption For 2021 Phelps Laclair

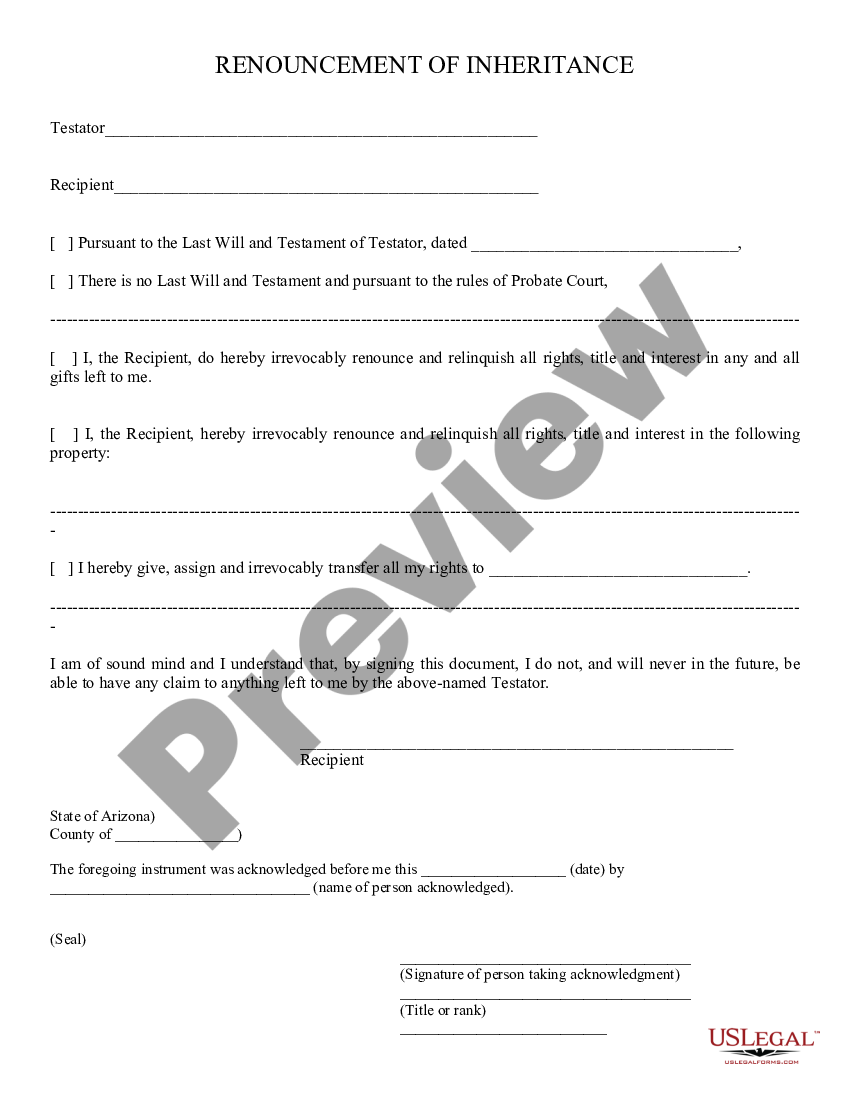

Arizona Renouncement Of Inheritance Arizona Inheritance Us Legal Forms

Is There An Inheritance Tax In Arizona

Death And Taxes Nebraska S Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Estate Planning Update Helsell Fetterman

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Where Not To Die In 2022 The Greediest Death Tax States

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

New York S Death Tax The Case For Killing It Empire Center For Public Policy

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Arizona Inheritance Estate Tax How To Legally Avoid

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Arizona Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Tax Planning Estate Planning Gift Tax Exclusion Phoenix Tucson Az